Investment perspective 2020: Construction industry

2019 is considered a failed year of the construction industry with a sharp decline of most of the key stocks. Will the situation improve in 2020?

Deceleration in 2019

The construction industry has developed stably in recent years mainly due to the positive influence from the real estate sector. With the rapid urbanization rate and the increasing proportion of urban population to the total population, construction demand in Vietnam is always high.

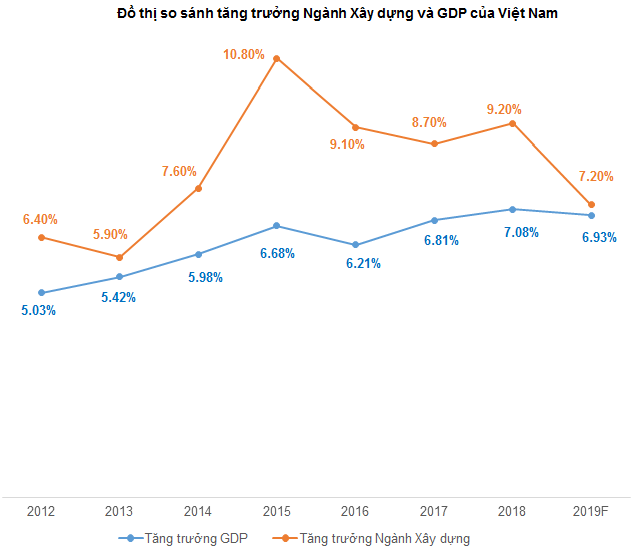

The growth rate of the industry since 2012 has always been much higher than the GDP growth rate. However, in 2019, experts expect the industry growth rate will be only 7.2%.

Source: VietstockFinance and Business Monitor International

Cautious short-term, long-term optimism

Since 2018, the real estate market in Ho Chi Minh City has been squeezed to license new projects so far. Analysts expect this situation to continue but not too strict in the coming years and help construction enterprises "breathe" more easily.

On the other hand, according to BMI (Business Monitor International), the construction industry will maintain an average growth rate of about 7.6% during 2018-2025. PwC's research shows that Indonesia, Vietnam and the Philippines are the countries that can get the greatest attention from international real estate developers in the ASEAN region. This proves that the industry prospect is still very good in the long term.

Therefore, the adjustment of these industry stocks (if any) in 2020 is expected to be an opportunity for investors to buy at reasonable prices. The shortened strategy of shortening and surfing will most likely not work for this industry. Buying for long-term goals of 3-5 years will be more reasonable.

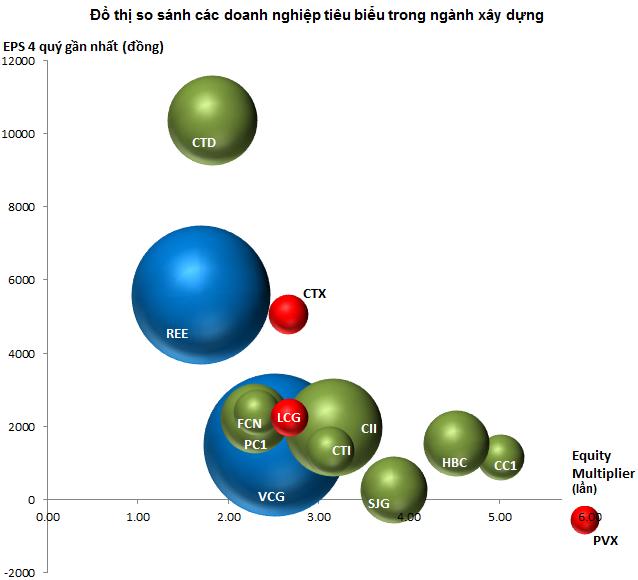

Source: VietstockFinance

Note: Stocks shown in blue balls are Large Cap. These Mid Cap stocks are shown by the green ball. Small & Micro Cap stocks are red.

The remarkable business

Hoa Binh Construction Group Corporation (HOSE: HBC)

Being in the group of Equity Multiplier leverage at the highest level but HBC has started to make significant improvements recently. This ratio has decreased from 5.68 at the end of 2017 to 4.53 at the end of the third quarter of 2019.

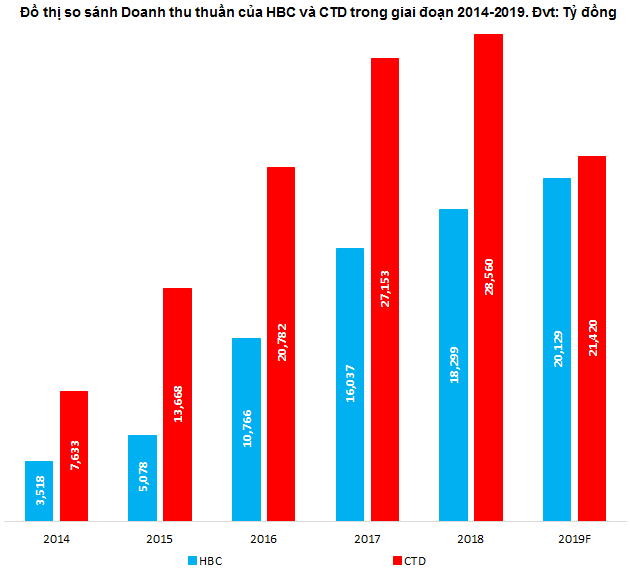

Although the company's profit is expected to reach only about 60% of the plan, revenue still grows. This is a big difference when comparing with the peer competitor Coteccons Construction Joint Stock Company (HOSE: CTD). Not only is profit shrinking, CTD's revenue is expected to decline sharply in 2019.

Source: VietstockFinance

From 2020, HBC has a plan to improve liquidity and cash flow. Accordingly, Hoa Binh plans to issue USD 50 million of convertible bonds (about VND 1,200 billion), in order to pay short-term debts, supplement working capital at the end of the year and use the remaining amount to reinvest in the public. member companies, developing industrial infrastructure and restructuring construction material production to form a value chain, completing the Group's core business.

Recently, Korea Investment Management Co Ltd made a purchase of nearly 1.2 million shares, raising its holding at HBC from 4.60% to 5.11%. Accordingly, this organization has become a major shareholder of HBC since October 2, 2019. This partly reflects the confidence of foreign investors in HBC's long-term prospect. The price range of 9,500-11,000 is considered very attractive to buy into HBC for long-term investment purposes.

Refrigeration Electrical Engineering Corporation (HOSE: REE)

Among construction enterprises, Refrigeration Electrical Engineering Corporation (HOSE: REE) has participated and invested in the most successful industries. The stability of areas such as real estate for rent, electricity generation, water supply, etc. makes REE the least affected business from the fluctuations of the construction market.

After testing the historical old peak (calculated at adjusted price) of 39,000-41,000 at the end of September 2019, REE shares corrected continuously in the following months. Currently, the price is heading to the long-term support trendline (equivalent to the area of 33,500-34,500). Buying in can be done when the price returns to this zone.

Source: VietstockUpdater

Coteccons Construction Joint Stock Company (HOSE: CTD)

This business is going through the most difficult challenge in recent years. Both revenue and corporate profits have declined, projects are stuck in implementation, and the source of jobs is less, making bidding competition increasingly fierce.

Troubled construction market is the first thought when talking about CTD's deteriorating business results. But looking at the main competitor is HBC, the profit of this business is backward but the revenue is still growing, hardly anyone is satisfied with that simple explanation.

Investors are still concerned about whether CTD is facing the risk of "gutting" customers and a team of skilled experts when the Central Cons was established by former Deputy General Director Tran Quang Tuan. at breakneck speed. According to the Central Cons website, the company has more than 800 engineers and 10,000 workers working on 39 large and small projects with a total contract value of up to 10,000 billion. A fledgling construction company that has just been established for more than 2 years but has signed a contract worth up to VND 10,000 billion is really formidable!

Many people still worry whether this is a form of "cicadas escape" of Coteccons or not? The writer did not comment deeply on this. However, facing businesses that are suspicious of ethical risks, the best solution is to temporarily continue to observe and not rush to invest.

Enterprise Analysis Department, Vietstock Consulting Department